180 Degrees in 181 Days

1Q 2019

Dalbar, a firm that has been analyzing investor returns based on cash flow data from mutual funds since 1994, recently reported that the average investor lost twice as much as the S&P 500 in 2018. Their latest Quantitative Analysis of Investor Behavior report estimated that the average investor lost 9.4% during the full year. This finding is in-line with its longer-term analysis, showing that the average investor often earns less than what a diversified portfolio of market indices would provide. Much of the discrepancy is due to investors trying to time the market, chasing performance, or a lack of investment discipline.

Sadly (given the sharp reversal and investors’ market timing ambitions), if we had to guess, the average investor’s experience in the first quarter of 2019 was likely no different from the study’s trend. Recall that at the end of 2018, many investors were nervous following a near bear market in stocks. Many pundits were calling for stocks to continue falling into the New Year. The clouds overhanging the markets included trade tensions, Brexit, slowing growth estimates, the Fed continuing to raise rates, and a yield curve inversion. The cover of Barron’s Annual Roundtable edition (a collection of interviews which took place on January 7th, 2019 with “10 of Wall Street’s smartest investors”) read, “Our panelists see stocks stumbling in the first half of 2019 but sprinting higher in the second half.”

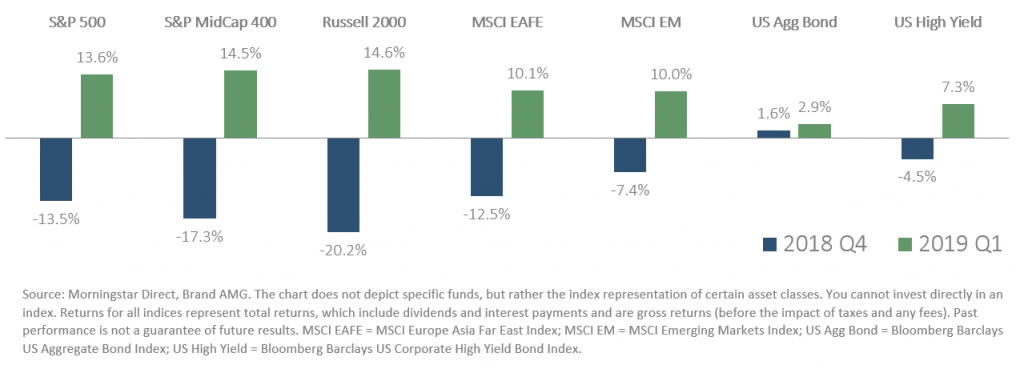

Instead, what happened was an about-face as the Fed decided not to hike interest rates at its January meeting and US-China trade rhetoric cooled. The S&P 500 finished the first quarter up 13.6% including dividends – it’s best quarterly performance since the third quarter of 2009 – while mid-sized companies and smaller companies fared even better (+14.5% and +14.6%, respectively). International developed market stocks were +10.1% for the quarter – positive, but again trailing the performance of US stocks as they continue to grapple with the uncertainty of Brexit and slowing economic growth in many of the other large European markets. Emerging market stocks were +10.0% – also trailing US stocks given the continued uncertainty associated with global trade tensions.

Within fixed income markets, interest rates generally moved lower since the beginning of the year given the market’s impression that the Fed might reverse course and instead cut rates in 2019. The move lower in interest rates contributed to positive returns for bonds (when rates fall, bond prices rise) to the tune of +2.9% for the Barclays US Aggregate Bond Index year-to-date. High yield bonds (which are more risky, but also offer a higher return) returned even more at +7.3%.

While we are pleased with the short turnaround following the fourth quarter volatility, we remind investors that trying to time the markets is a difficult endeavor. Typically the best days of the year occur within a few days of the worst days, and by trying to avoid a market decline, investors must also make another bold decision – that of deciding when to get back into the market. Picking the exact days to exit and then return is very often a fool’s game, and one that leaves “average investors” with below average returns.