2020 Hindsight: One for the Record Books (Keep the Book – I Don’t Want it Back)

4Q 2020

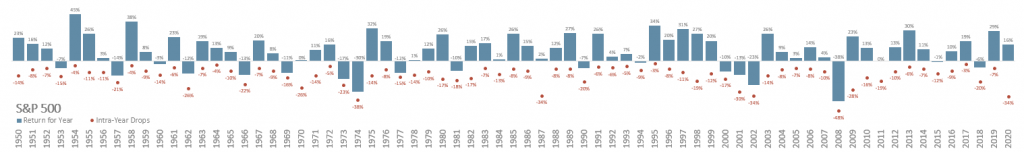

For most of the last decade, the US stock market had been trending generally higher year after year. That was until the fourth quarter of 2018 gave us a scare. Back then we remarked how it was the first drop of greater than 15% in seven years and how unusual that was (because on average it happens once every three years – see the chart below, a version of which we also shared in our 2018 year-end market commentary).

Early in the year 2020 it looked like it was going to be just another good year for markets. US large cap stocks (as measured by the S&P 500 Index) peaked on February 19th, +4.8% in just seven weeks. Over the next 23 trading sessions, as the severity of COVID-19 came to light, the S&P would set a record for the fastest bear market in history, but then fully recover over the next five months (setting a record for the fastest bear market recovery in history).

When it was all said and done, the S&P had fallen 33.8% from the February peak, bounced +70.2% from the bottom, and ended the year +12.7% (on a total return basis, including dividends). Small cap stocks (represented by the Russell 2000 Index) had an even wilder ride, falling 40.7% from the peak to March 23rd, rising 99.1% from there and ending the year +18.1%.

Interestingly, the final third of the year saw a rotation of strength out of large cap growth stocks, which have dominated performance over the prior five years, and into value stocks and small caps. For style context, large cap growth stocks (represented by the Russell 1000 Growth Index and dominated by big technology names) were +6.2% over the final four months of the year while large cap value stocks (represented by the Russell 1000 Value Index) were +13.4%. On the size comparison, large cap stocks (S&P 500) were +7.9% in the final four months while small cap stocks (Russell 2000) were +27.0%.

Other asset classes were positive performers on the year, as well. International developed market stocks (MSCI EAFE Index) were +7.8% and emerging market stocks (MSCI EM Index) were +18.3%. As the Federal Reserve and other central banks all over the world pushed interest rates lower to induce liquidity into markets to contend with COVID-related economic stresses, bonds also moved higher. In the US, the overall bond market (represented by the Bloomberg Barclays US Aggregate Bond Index) was +7.5%, while high yield bonds finished the year +7.1% and emerging market debt was +6.5%. Real estate was one of the few markets ending lower on the year, with the S&P Global REIT Index -8.1%.

If someone told you at the beginning of 2020 that we would experience a global pandemic the likes of which we haven’t seen in 100 years, entire countries would impose lockdowns and close their borders, the price of oil futures would go negative, GDP would fall by the largest amount on record, unemployment would rise from 3.5% to 14.7% within two months, and we would have a very contentious presidential election, would you have wanted to invest in stocks? And yet for an investor that would have chosen cash and avoided all that volatility, they would have missed out on what became 33 new all-time highs and an 18.4% gain in the S&P 500 – the fourth best annual return in the last ten years.

The phrase “hindsight is 20/20” is usually used to refer to something that didn’t work out well. This past year gave the phrase a whole new meaning (on many different levels). However, for being such a difficult year, it definitely presented many good lessons for investors – on market timing, discipline, the power of rebalancing, and the savings that can be achieved by tax loss harvesting. When things got rocky, we got busy (very busy). And while we are grateful for all the opportunities presented in 2020, we certainly hope 2021 (or any year for the rest of our careers, for that matter) doesn’t test investors in the same way.

(click to enlarge)