Making Progress, Yet Still Room for Improvement

3Q 2020

Following the best quarterly performance for US stocks in 23 years, the S&P 500 continued to move higher throughout most of the third quarter. At one point in early September, the S&P 500 was +15.9% for the quarter and posting new all-time highs. However, renewed concerns over rising COVID cases in the US and Europe, as well as pre-election anxieties in the US resulted in an end-of-quarter pullback.

The S&P 500 ended up +8.9% for the quarter (on a total return basis, which includes dividends), driven mostly higher by growth stocks (+13.2%) which continued to outperform value stocks (+5.6%). Mid-sized and smaller stocks were +4.8% and +4.9%, respectively. International markets performed well too, with developed markets ending the quarter +4.8% and emerging markets +9.6%. In the world of bonds, interest rates have been largely unchanged ever since the start of the second quarter. With Treasury bonds returning next to nothing, “credit” performed better, with corporate bonds +1.5%, high yield corporate bonds +4.6%, and the Bloomberg Barclays US Intermediate Aggregate Bond Index (comprising a mix of government and investment grade corporate bonds) finishing the quarter +0.5%.

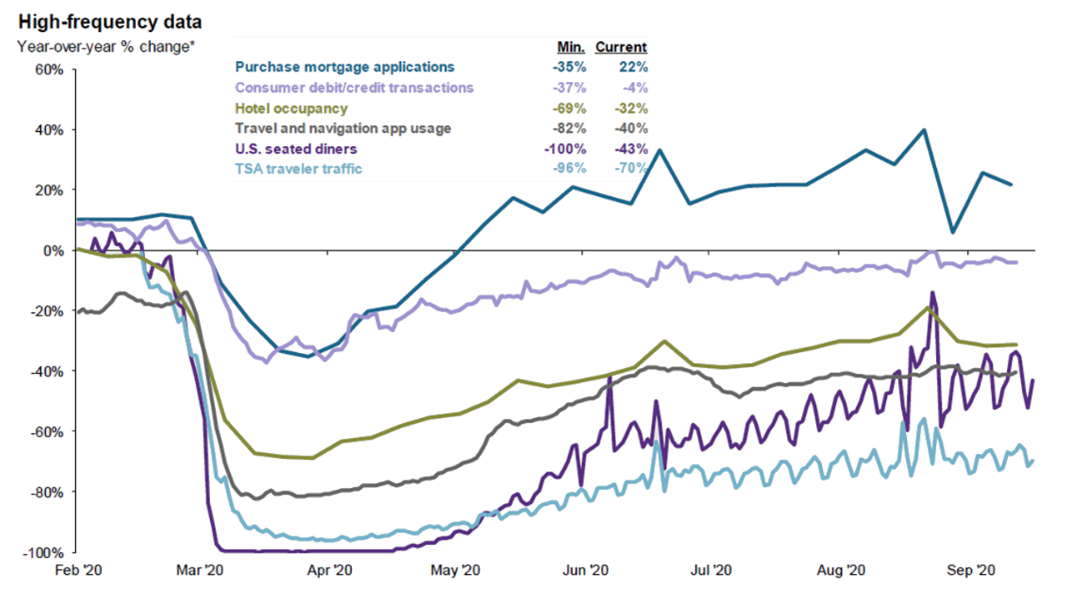

Although the pandemic continues to weigh on the world, the global economy is emerging from recession and transitioning into gradual recovery. In the US, we have recovered about half of the jobs lost since the pandemic first emerged. But there’s still a lot of work to be done, and the second half of the jobs recovery will likely be slower than the first. As we examine other, more frequent datapoints within the US economy (see chart below), we see a similar story playing out: that some of the hardest hit sectors, while still below year-ago levels, are well off the bottom and continuing to trend higher. From a total economic output perspective, we’ll soon see (in late October) how third quarter GDP shook out, but most analysts expect a sharp reversal from the -31.4% second quarter GDP reading.

As we enter the final quarter of an already tumultuous year in the midst of a global pandemic and civil unrest, with colder weather setting in, and with a contentious presidential election in the next few weeks, we acknowledge there appear to be a plethora of reasons for volatility to resurface. However, we believe there are several reasons to be optimistic about our longer-term economic prospects:

- While politicians appear unable to compromise on additional fiscal stimulus, eventually we believe more help is on the way.

- The Federal Reserve has committed to remaining accommodative, expecting interest rates to remain low for a long time.

- Soon the election will be over, and businesses will be able to turn their attention to the future with more clarity.

- Additionally, with each day we grow closer to a vaccine and the ability to put the COVID era in our rearview mirror. Once we’ve turned that corner, healing can begin in earnest.

We encourage investors to filter out the short-term noise and stay focused on the long-term benefits of staying invested. Over the long-term, risk premiums (returns that are expected to exceed those from “safe” investments) are earned by those who embrace risk, especially during times of uncertainty. Alongside each of our clients, we’ve crafted long-term investing playbooks. With each episode of market uncertainty, those playbooks are pulled from the shelves and implemented, over time earning creases like wrinkles on the face of wisdom. Should the road get bumpy again, we’ll refer to the wisdom within the playbooks and do as we always do: stay diversified, maintain discipline, rebalance and tax loss harvest where appropriate.