Global Sanctions Continue To Punish Russia

Last Friday, Vanguard and other fund companies announced they would be selling all holdings related to Russian stocks or bonds over the weekend, pursuant to international sanctions. The announcements also noted that many international index providers (e.g. FTSE Russell and MSCI) would also be removing Russian stocks from their indices. For context, Russian securities comprise only about 1.5% of all emerging market stocks, so while the news is small relative to the world of international investing, the messaging and ramifications to Russia are much bigger.

As seen in the chart below, the Ruble has fallen ~50% over the past month. This means the cost of every good that is imported into Russia just doubled for Russian citizens (assuming they can even procure those goods in the first place, as we will explain later).

Source: Google, as of 11:50 am Central on 3/7/22.

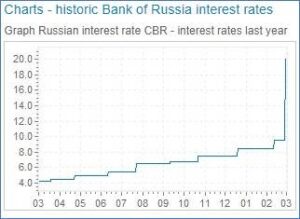

The Russian Central Bank raised its key interest rate to 20% (see below) on Monday, February 28th. They did this to try to curb the decline in the Ruble (and stem rising inflation resulting from currency depreciation). It clearly didn’t work (see above).

Source: Global-rates.com, as of 3/7/22.

The Russian Central Bank had also planned on selling some of their $630 billion in foreign currency reserves to help defend their currency. What they didn’t expect was for most other global central banks (the US Federal Reserve, European Central Bank, Bank of Japan, Bank of England, etc.) to freeze their assets (about 50% of their currency reserves were held in foreign central banks).

Now, Putin has ordered Russian companies to suspend any debt payments owed to foreign institutions to conserve Rubles for its domestic economy. This means a likely Russian debt default, which will damage their credit ratings and hamper future access to capital markets for Russian entities, just as it has done for Venezuela and Argentina. It will take a long time to unwind the damage caused. Eventually, once Russian entities are allowed access to capital markets in the future, the interest rates required to borrow money will likely include a much higher risk premium (i.e. their interest rates will be significantly higher going forward), which will limit economic growth for the country for the foreseeable future.

Additionally, commercial banks across the world have frozen Russian assets and the list of companies refusing to buy Russian goods, sell goods into Russia, or invest money into Russian projects grows longer with each day. Visa and Mastercard stopped processing transactions for millions of Russian citizens. Apple and Google shut off smartphone-enabled payments, stranding cashless travelers at Moscow metro stations. International financiers have stepped away from trade financing and trade insurance, which has caused Maersk (the Danish shipping giant) to suspend any deliveries to Russia.

Many global companies have suspended Russian operations, which will likely cause a rise in Russian unemployment. Ford, Volkswagen and Toyota have discontinued production and any joint ventures within Russia. Boeing and Airbus have suspended parts and support to Russian airlines. The world’s largest consulting firms (Accenture, McKinsey and Boston Consulting Group) and accounting firms (Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers) have all cut ties with Russian firms. Energy giants BP, Exxon Mobil and Shell have either halted or exited their joint ventures with Russian energy companies. Retailers like IKEA, Nike, H&M and TJ Maxx are temporarily closing all stores. UPS and FedEx have suspended all shipments into Russia.

The squeeze is on for the Russian economy and it is becoming increasingly isolated, with longer-term repercussions mounting by the day. Russian citizens will pay a heavy price for this war. The question is: how long will they stand for it? So far, we are only about a week and a half in. Already thousands of Russian protestors have been locked up. But, as shortages mount and the potential for hyperinflation wreaks havoc within the Russian economy, we will likely see more protests which may reach a tipping point. Perhaps Putin should “beware the Ides of March”.