Endurance, Part II

By Tim Egart, CFP®, AIF®

Last year, we shared a blog describing the harrowing experience of Ernest Shackleton and his crew as they embarked on a journey to cross the Antarctic continent. See that blog post here. While our current bear market pales in comparison to their life and death experience, we sought to connect the adventure in two ways:

- Certain investing seasons can often make us feel like we’re “drifting at sea” hoping for a lifeline.

- We must endure our present circumstances if we are to fully enjoy the ultimate recovery.

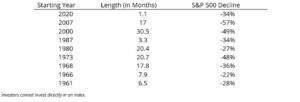

To that end, below is a recap of some of that data with a bit more thought surrounding our current market. As a reminder, this timeline1 encompasses a 50-year history of other bear markets (i.e. a decline of 20% or more):

As of March 14, 2023, the S&P 500 is hovering around an ~18% decline since the market high on January 4, 2022. The S&P 500 bottomed out in October 2022 with a ~24% decline. Whether we re-test those lows in this cycle or not is anyone’s guess, but that’s not quite the point. As we noted before, the challenge for many investors isn’t as much the magnitude of the decline (though it can be), but the length of the bear market. To some investors, the consistent volatility combined with an inability to make any material positive headway makes this market feel like “death by a thousand cuts.” Thus, our behaviors and emotions become even more important in markets like this. One of our favorite ways to describe how our emotions impact our ability to generate long-term wealth can be described in the illustration below2:

When markets make us feel invincible, we’re actually at the point of maximum financial risk. When markets cause emotional despair, it can be a point of greatest financial opportunity. As an example, we’ll examine the events of March 2009 and the Global Financial Crisis. While there was fear, angst, and despondency in the markets during that time, a well-diversified investor that consistently rebalanced came through that experience and went on to higher highs. We can debate which emotions the current market is provoking, but it’s certainly hard to argue anyone is excited, thrilled, or euphoric. Thus, it’s critical to separate our emotions/behaviors from the application of a well-thought-out financial plan focused beyond our current market experience.

As we noted in the original post, every single prior decline had one thing in common – they all ended. When a recovery begins (and it will), it often happens swiftly. Typically, the best days in a new bull market will occur right at the beginning – when investors collectively have panicked, capitulated, and become despondent. Whether that happens tomorrow or in the months to come, we can’t predict with perfect clairvoyance. We simply know that a recovery will occur.

Our team continues to monitor portfolios, markets, and world events. If you have any questions or concerns, we are always happy to connect. We’ll end this post like our original Endurance note. As with past bear markets, you will endure this one. And at least we’re not floating on an iceberg.

1https://www.mymoneyblog.com/sp-500-bear-bull-market-historical-list.html

2https://www.onedayinjuly.com/the-cycle-of-investor-emotion