“Gyro or Euro?” (A Greek Tragedy)

2Q 2015

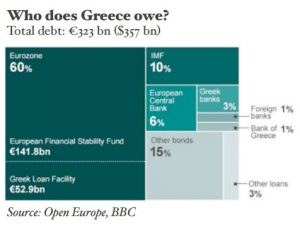

Although maybe not in the way that Sophocles would have scripted it, Greece is again the center of the world’s attention. With most global stock markets performing well only five days short of the end of the quarter, a standoff between the Greek government and its’ creditors sent markets stumbling into the close. Later, on July 5th, the Greek voters officially rejected the creditors’ latest round of demands in a referendum called by Greek Prime Minister Alexis Tsipras. The vote cast a dark cloud over the markets as investors struggle to piece together what happens next.

Elsewhere, Chinese stocks have been volatile and in decline since the end of April, currently more than 10% below their peak. Puerto Rico’s Governor recently admitted that the commonwealth’s $72 billion in bond debt is “unpayable.”

Domestically, anticipation of when the Federal Reserve will finally raise interest rates has bond market yields shifting in either direction with almost every economic data point released. In general, rates have trended higher. And while every tick higher offers some incremental appeal to those nervous about stocks (along with the notion of bonds being a “safer” investment), investors considering that option must confront the reality that if rates continue to rise, the value of those bonds purchased can decline. To say there are many cross-currents in today’s markets would be an understatement – and one which is exploited by news outlets and fear-mongers.

The S&P 500 (+2.7% with five days left before quarter-end) finished the second quarter lower by 0.2% in terms of the value of the index, but +0.3% when you include dividends (aka total return). Small cap US stocks posted similar results, while mid-caps finished the quarter negative, under-performing the small cap group for the third consecutive quarter.

International stocks were on pace to have a great quarter until they were roiled by Chinese volatility, Greece and Puerto Rico. Large cap international stocks were as high as +6.4%, but finished the quarter +0.8%, while international small caps were +8.5% and finished +4.5%. Similarly, emerging market stocks which were up nearly 10% in April alone finished only modestly higher at +0.8%.

Interest rates rose during the quarter, with the ten-year Treasury yield starting the quarter at 1.94%, moving higher in late April and finishing the quarter at 2.35%. The gradual move higher negatively impacted both real estate (a traditionally rate-sensitive sector) and bonds. The Barclays US Aggregate Bond Index (the benchmark for US bonds) ended the quarter -1.7%.

Global credit events (like Greece and Puerto Rico), regional volatility (like Chinese stocks), and economic cycle transitions (like the Fed’s eventual rate hike) generate headlines which tend to scare investors, but we would remind readers that they also create opportunities to rebalance and let discipline really work for you. Importantly, a closer look at the fundamental data points beneath the headlines reveals positive trends in most economic indicators – even those in Europe.

Finally, we would note that it is always darkest before the dawn – meaning that we live in such a complex adaptive world that even the best analytical models seem unable to accurately predict the outcome of complex events when several factors (e.g. economic, political, etc.) are moving independently. We can’t control what Greece, Puerto Rico, China or the Fed does, but we know from experience that maintaining discipline with a sound long-term strategy is something we can control, and something that generally bears fruit when the storm has passed.