“The Hedgehog Concept” by Tim Egart

Unless you’ve been living under a rock for the last twenty years, you’ve heard of one of the seminal business books of our time, Good to Great. In this book, Jim Collins and his colleagues seek to answer why some businesses become great companies and why others don’t. What is it that makes these companies better than their peers? Why did Gillette become a formidable name brand in men’s care products while rival Warner-Lambert (ever heard of them?) was relegated to the ash heap of history? What was it that Kimberly-Clark, Abbott, or Walgreens did that made them a Good-to-Great company?

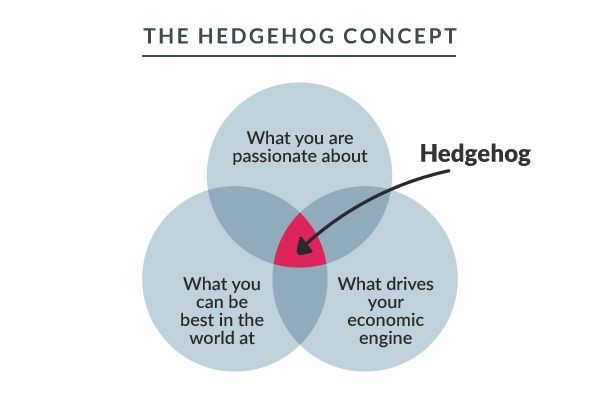

In Good to Great, Collins introduces The Hedgehog Concept: “a simple, crystalline concept that flows from deep understanding about the intersection of the following three circles… what you are deeply passionate about, what you can be the best in the world at, and what drives your economic engine.”

Their research indicated that the firms who established their Hedgehog Concept went on to outperform their rivals.

Applying Collins research to the world of investments and financial planning, is it possible to have a Hedgehog Concept that guides actions towards portfolio management? Taken another way, can we become Good-to-Great investors? Through three primary objectives, I believe we can.

Concentric Circle #1: What is your allocation

Where will you invest? How will you invest? How much risk is okay? You should have a deep understanding of the answers to these questions for yourself and your family. While research debates exactly how much of a portfolio’s return is determined by the allocation, or if an allocation’s primary benefit is volatility control (see Setting the Record Straight on Asset Allocation), there is absolutely no question of the importance in establishing one. Define and commit to an asset allocation that guides how you will manage your wealth. It is a hallmark of a great investor.

Concentric Circle #2: What drives your decisions

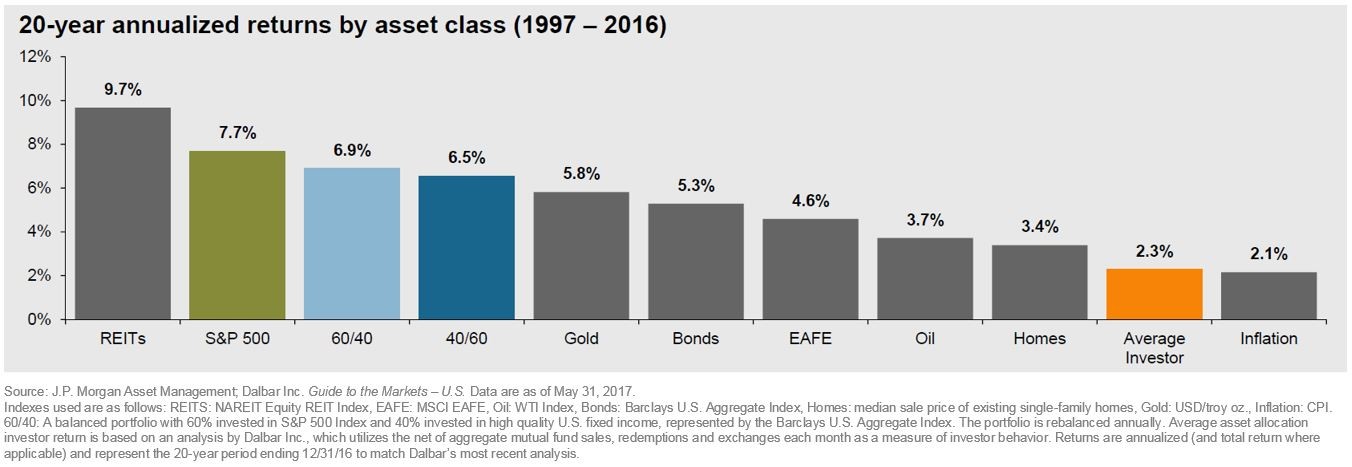

Possibly the most difficult thing to do in practice, applying discipline to your allocation is vitally important. Dalbar’s 2017 study showed the average investor made 2.3% annualized from 1997-2016. Meanwhile, a standard 60% equity, 40% fixed income structure made 6.9% during that same period.

Why such poor performance for the average Joe? Many investors try to time the market believing they can predict the direction it will move. Looking back only a year’s time, some investors thought the market would implode if Donald Trump was elected President and subsequently cashed out their investments. If you made that bet, the opportunity cost of your trade is fairly significant. Even worse, you’re now stuck with the decision of trying to figure out when to buy again.

Applying discipline to an allocation removes our emotions and natural tendency to predict the future from our investment process. Decide now what you will do when you get scared, nervous, or excited about the markets. Will you chase those emotions or will you hold to your process?

Concentric Circle #3: What you can impact

Many individuals feel they’ll only be able to achieve a particular goal if they achieve a certain return in the market. However, how the market behaves in any given time period is completely out of our control. We can’t depend on the market to make up for a poor savings strategy. What is far more important for the average investor is to ensure that their savings strategy works in various market environments. Over time, what we save (and what we spend) will have a much more profound impact on our financial lives than whether Apple beats The Street’s estimates for the next quarter or not.

Conclusion

You may be thinking that this is over simplifying things. There are hundreds of books touting complex methods of identifying the next investment unicorn, chasing stocks or sectors with a promise of 40% returns (or more). However, research shows that it is the simple big-picture steps, executed with discipline, that make the real difference for investors.

Don’t be fooled – while simplicity is easy as a concept, it can be challenging to execute. It takes commitment and discipline, but our financial lives could be far better off if we applied a simple Hedgehog Concept.

Sources

- Good to Great by Jim Collins.

- JP Morgan’s Guide to the Markets (U.S. 1Q 2017 as of 1/31/16) featuring Dalbar Inc.’s study on the average investor (see page 64).

- The CFA Institute’s blog post, Setting the Record Straight on Asset Allocation by David Larrabee, CFA.