Unexpected Returns

4Q 2013

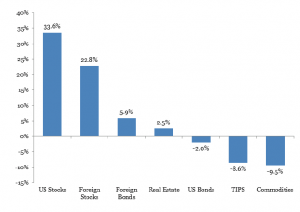

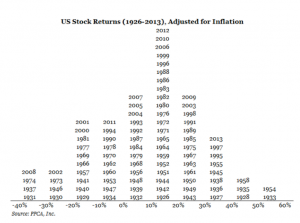

Some years are boring. Everything works more or less like you expect. The year 2013 was not one of those. As you review the enclosed results, it will become quickly obvious that the equity markets in the United States and other developed nations around the world posted one of the best top-tobottom results of the last 20 years. Both the S&P 500 and the Dow Jones Industrial Index finished the year at all-time highs, with 2013 providing the best return since 1997. Additionally, the 5 years ending 2013 is the third-strongest 5-year period since 1933 for the S&P 500. Developed markets worldwide posted 23% to 33% returns. Other asset classes struggled to keep up (see graph below).

It seems so long ago in January of 2013, in the dark of night, congress and the President signed the needed documents to avert, or at least delay, the arrival of the dreaded “fiscal cliff.” In the end, the cliff left no lasting visible scars. Quite a start to a year that only got more interesting as it went.

In a potential harbinger of things to come, we saw three seemingly “inevitable” occurrences come to pass. In July, the City of Detroit declared bankruptcy becoming the largest municipality in U.S. history to do so.

In October, the government shut down for more than two weeks. The Federal Reserve chairman hinted (May 2013) and then followed through (December 2013) with an “easing of the quantitative easing” that has been a part of our economy since the depths of the last recession.

Each of those events were anticipated to be the catalyst for an equity market downturn. But, that didn’t happen. Instead, the bond market posted its worst annual loss since 1994 at -2.0% on the Barclay’s Capital Aggregate Bond Index. It should be noted that a bear market in bonds looks materially more sedate than a bear market in stocks (think -38% in 2008). Gold, which is typically thought of as a safe haven for turbulent times, was down 28.2% for the year.

This brings us into 2014 hoping for more success in the face of frustration. We fully expect new frustrations in the coming year. If we wished upon ourselves the same levels of challenge as 2013, it would be cruel – but, hopefully just as rewarding for investors.

We’ll look forward to seeing how and if Chairman Yellen differs from her predecessor, and hope she can continue to navigate the ship through stormy waters.